Sponsors and Equity Investors

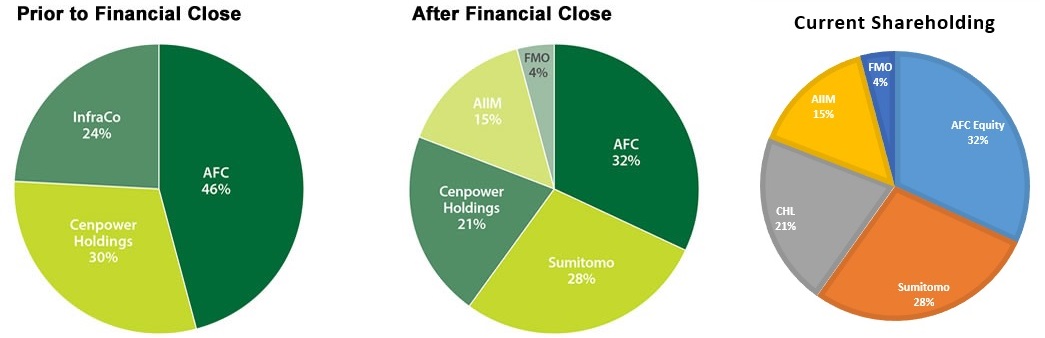

Through equity injection, three leading investment groups joined the project in 2014, whilst InfraCo, a project co-developer since inception, exited the project. The new investors were Sumitomo Corporation of Japan, African Infrastructure Investment Fund II and its co-investors (via an investment vehicle called Mercury Power) and FMO. The project founders (through their vehicle, Cenpower Holdings) and AFC, remained as project Sponsors.

Cenpower Holdings

Cenpower Holdings Limited, a wholly-owned Ghanaian special purpose company, was established in 2010 as a vehicle for the Founding Shareholders investment in Cenpower Generation Company Limited. The founding shareholders comprised a group of Ghanaian entrepreneurs with a broad range of skills and local development expertise, coupled with individual experience in energy, finance, law and international business.

The Africa Finance Corporation

The Africa Finance Corporation (‘AFC’), a multilateral finance institution was established in 2007 with a capital base of circa US$1 billion to be the catalyst for private sector infrastructure investment across Africa. AFC fills a critical void in providing project structuring expertise and risk capital to address Africa’s infrastructure development needs and, increasingly, is being seen as the benchmark institution for private sector investment in the core infrastructure sectors of power, natural resources, heavy industry, transport, and telecommunications. AFC is one of the highest investment grade-rated multilateral finance institutions on the African continent, with an A3 (long term)/P2 (short term) foreign currency debt rating by Moody’s Investors Service.

Sumitomo Corporation

Sumitomo Corporation is one of the world’s leading diversified conglomerates, listed on all the key Japanese stock exchanges. In 2013, it generated revenues in excess of US$30 billion. As well as being Cenpower’s Strategic Technical Partner, Sumitomo leads the operation and maintenance of the plant. Sumitomo Corporation is a leading general trading company, headquartered in Tokyo, Japan, with 116 locations in 65 countries and 24 domestic locations.

The Sumitomo Corporation Group consists of nearly 800 companies and more than 70,000 personnel. Its core business units are metal products, transportation & construction systems, environment & infrastructure, media, network, lifestyle related goods & services and mineral resources, energy, chemical & electronics. Sumitomo is one of the leading IPP developers, with interests in more than 6,300MW of net installed capacity worldwide.

African Infrastructure Investment Managers

African Infrastructure Investment Managers (‘AIIM’) was established in 2000 as a joint venture between the Macquarie Group and Old Mutual Investment Group (Pty) Ltd. AIIM has funds under management in excess of USD1 billion. The funds managed and advised by AIIM are designed to invest long-term institutional unlisted equity in African infrastructure projects such as airports, ports, pipelines, power generation, toll roads, renewable energy and communication infrastructure assets. Its African Infrastructure Investment Fund 2 (AIIF2) is designed to invest long-term institutional equity in a diversified portfolio of infrastructure and infrastructure-related assets, across Sub-Saharan Africa.

FMO

FFMO (Netherlands Development Finance Company) is the Dutch development bank. FMO supports sustainable private sector growth in developing and emerging markets by investing in ambitious entrepreneurs. FMO believes that a strong private sector leads to economic and social development, empowering people to employ their skills and improve their quality of life. FMO focuses on three sectors that have high development impact: financial institutions, energy and agribusiness, food & water. With an investment portfolio of EUR 6.6 billion, FMO is one of the largest European bilateral private sector development banks.

Our Debt Investors

Debt finance for the project is being provided by a consortium of five South African commercial banks, ( six leading international Development Finance

Institutions (DFIs) and & Export Credit Insurance Corporation of South Africa (ECIC).

Rand Merchant Bank (‘RMB’) acted as the Global Lead Bank and Mandated Lead Arranger for the commercial banking tranche. Other South African banks involved in the transaction at Financial Close as Mandated Lead Arrangers are Nedbank and Standard Bank.

The Export Credit Insurance Corporation (‘ECIC’) of South Africa, is providing the export credit cover for the South African commercial tranche.

Nederlandse Financierings-Maatschappij voor Ontwikkelingsanden N.V ('FMO') the Dutch Development Bank, is the Mandated Arranger for the DFI tranche.

Other DFI investors include:

- Deutsche Investitions-und Entwicklungsgesellschaft mbH - DEG.

- OPEC Fund for International Development – OFID.

- Industrial Development Corporation – IDC.

- Emerging Africa Infrastructure Fund – EAIF.

- Development Bank of South Africa – DBSA.